With abundance of choice when it comes to bitcoin exchanges in the market, it is quite easy to learn how to buy bitcoins. Our reviews of the available platforms are aimed to provide you with necessary knowledge about ways to buy bitcoins online. We recommend you to start with this quick guide to buying bitcoin.

Summary: How to Buy Bitcoins

With Coinbase you can buy bitcoin online using a credit card or bank account. Because we referred you, when you sign up and buy or sell $100 of bitcoin or more, you’ll earn $10 of free bitcoin!

- Find the best bitcoin exchange depending on your country of residence.

- Sign up. This will give you a secure place to store your bitcoins at the beginning.

- Add a payment method to convert your local currency into or out of bitcoin.

- Complete some verification steps before you can purchase large amounts of bitcoin.

- Buy bitcoins with a credit card, bank account (ACH or SEPA transfer), cash, or PayPal.

- Protect your assets from hackers and thieves by storing them in hardware wallets.

P.S. Don’t have a bitcoin address? Get it on Coinbase.

The Best Bitcoin Exchanges

Some exchanges offer the anonymous purchase of bitcoins without any verification...

Payment Methods to Buy Bitcoins

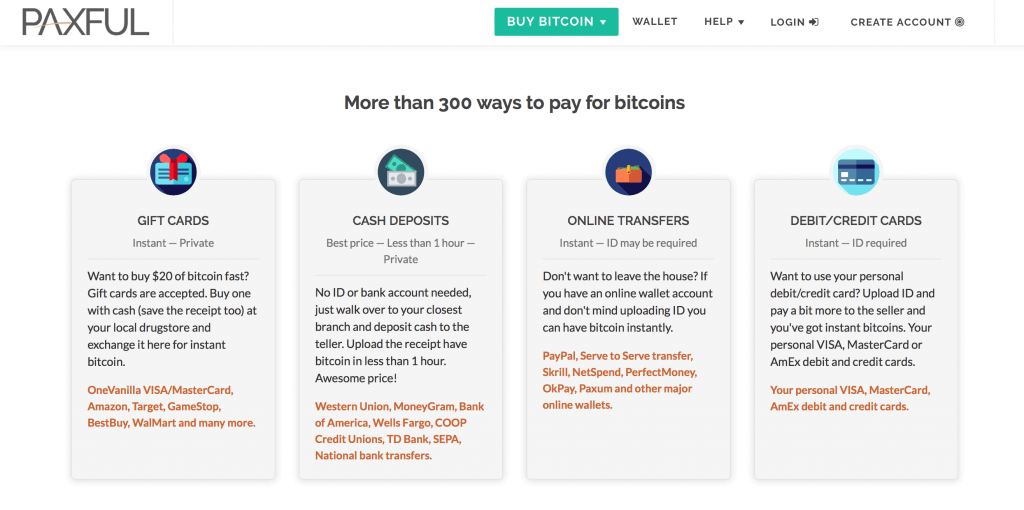

There are many ways to turn paper money into bitcoin and each of them...

The Fastest Ways to Buy Bitcoin

The fastest ways to purchase bitcoins are through credit card and ATM machines...

The Best Bitcoin Wallets

Whether you are buying bitcoins by a fellow trader or from broker, always...

Buy Bitcoins in Different Countries

Coinbase is the world’s most popular way to buy BTC. Earn $10...

Bitcoin iOS & Android Apps

The mobile applications that support the bitcoin trade are...

If you are looking for a place where you can get the ropes of trading with bitcoins, you couldn’t find a better place to start at! Investors are heaping on the BTC wagon as the value of it grows daily and does not show any signs of stopping in the foreseeable future.

This article represents an exhaustive pool of information about bitcoin in terms of where, how and when can you buy the cryptocurrency. After our review, you can be sure that as we walk and guide you through, you will gain answers to many important questions that each bitcoin investor needs to be aware of:

- Can I buy bitcoin online?

- How to earn online from bitcoin trades?

- What buying methods exist out there for bitcoin?

- Where can I purchase BTC?

- Where should I keep BTC?

- What kind of scams and frauds should I be aware of?

- How to get paid in bitcoin?

Best Ways to Buy Bitcoins

Buying and selling bitcoins could be done in numerous ways with each of them having their own pros and cons. The easiest way for someone else is not necessarily the best way for you, depending on where you live and what purchase method you could use.

Here’re the best ways to buy bitcoins using a credit card or bank account:

- Coinbase – USA, Canada, UK, Europe, Australia, and Singapore;

- Coinmama – Worldwide;

- CEX.io – Worldwide;

- BitPanda – Europe.

You can also check out our complete guide on how to buy bitcoins with a bank account or ACH bank transfer.

Purchasing methods have their own limitations and perks, so make sure you analyze each of them to be sure they fit your needs.

A Little About Us

We are a group of professionals dedicated to offering only the most accurate and relevant information available to our buyers concerning the bitcoin. We provide all necessary tools to harness knowledge and information for our customers.

We list all of the top sellers in the world, along with all the stats and facts that you need to know about while trading with bitcoins. Add to that up-to-date market analysis, professional opinions, and a growing community of our customers and you have a recipe for success.

Why Is Bitcoin So Popular?

How long has BTC been around us? BTC has been around for quite some time actually, from 2009 to be precise due to its popularity. There are several reasons for bitcoins popularity, one of them being fast growth in value for the past few years. From $1 in 2009 it quickly grew and is certainly a reason enough for investors to join the wagon.

It is the first cryptocurrency in the world, completely decentralized and market-oriented, making it quite attractive to invest in. Nobody controls it but the market and its community are growing each day, creating more room for bitcoin to thrive.

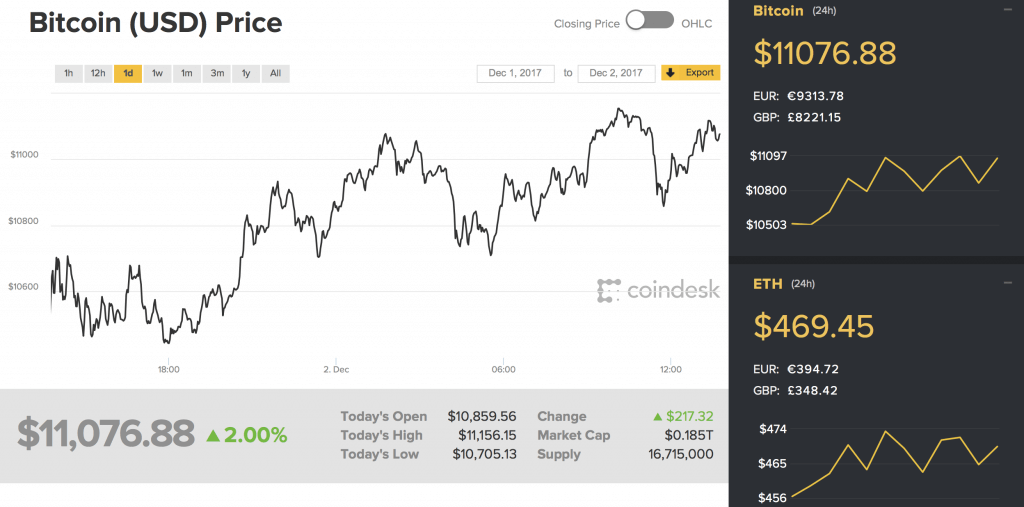

Bitcoins Price

Since it is decentralized, BTC’s value does not depend on one source like other currencies do but is rather market affected. From $1 in 2009, its value is constantly growing, which says a lot about its potential and what to expect in the future.

It is highly fluctuating currency, meaning you have an opportunity to buy cheap BTC one day, only to sell it much more expensive the very next day and earn nice profit out of the trade.

Best Bitcoin Exchanges and Traders

Currently, there are many brokers specialized in bitcoin trade that you could choose to work with, depending on their BTC trade services and location. They vary according to their regional service, transaction fees, purchase fees, and platform. Each of them has their pros and cons that you need to be aware of, while it is quite permissible to trade with more than one broker. Some of more famous of them are LocalBitcoins, BitQuick, LibertyX, Wall of Coins, Coinbase, Coinmama, BitPanda and many others. See the full Top 100 Bitcoin Exchanges List.

| Bitcoin Exchange | Quick Take | Countries | Deposit Method |

|---|---|---|---|

| Coinbase | The best way to buy bitcoin online in the United States, Canada, Australia, the UK & Europe. Liquid, low-fee US-based bitcoin exchange that holds multiple currencies. Due to our referral program, when you sign up and buy or sell $100 worth of bitcoin, you will earn $10 of free bitcoin! | USA, Canada, Australia, UK, EU, Singapore | Credit Card, Bank Account |

| Changelly | Instant cryptocurrency and BTC exchange with user-friendly interface. Fees are higher than the average as it provides speed and privacy (no ID verification). | Global including USA | Credit Card |

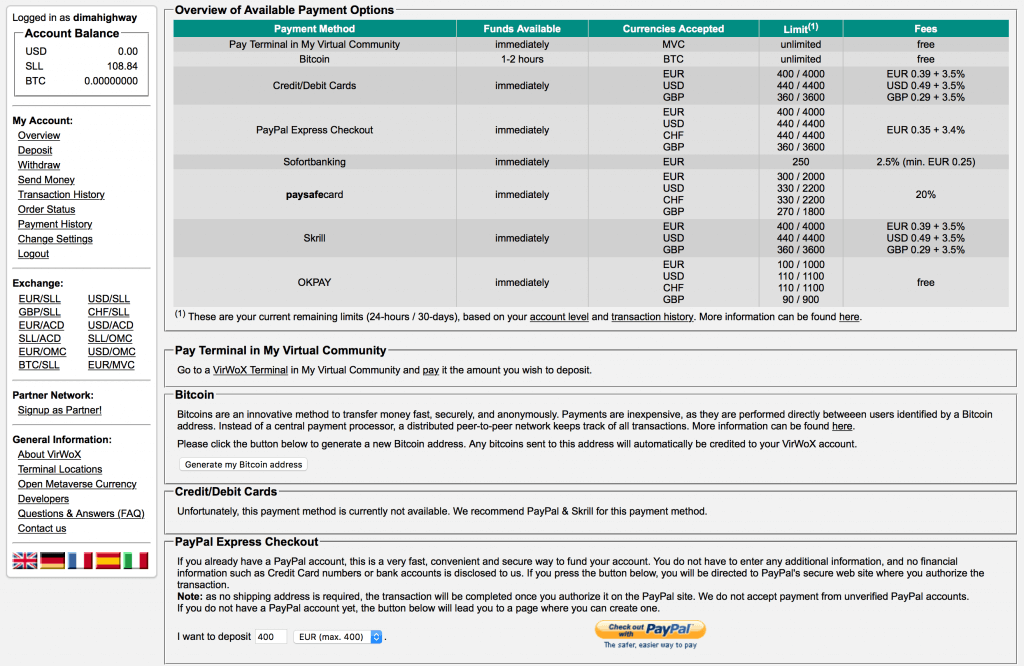

| VirWox | Buy bitcoins with PayPal: one of the main methods that people use to buy bitcoin is through PayPal. They charge a 10% commission fee for PayPal/BTC trading. | USA, Canada, UK, EU | PayPal |

| LocalBitcoins | The most private way to buy bitcoins through a peer-to-peer exchange. Operates everywhere. | Global including USA | Cash, Bank Account, PayPal, Gift Cards |

| CEX.io | Well-funded reputable and liquid bitcoin exchange. Great option worth checking out. | Global including USA, UK, EU, Russia | Credit Card, Bank Account, Crypto |

| Coinmama | Allows purchases of bitcoins with credit card to nearly everyone in the world. | Global including USA (22 states) At this moment, Coinmama exchange supports 40 U.S. states | Credit Card, Cash |

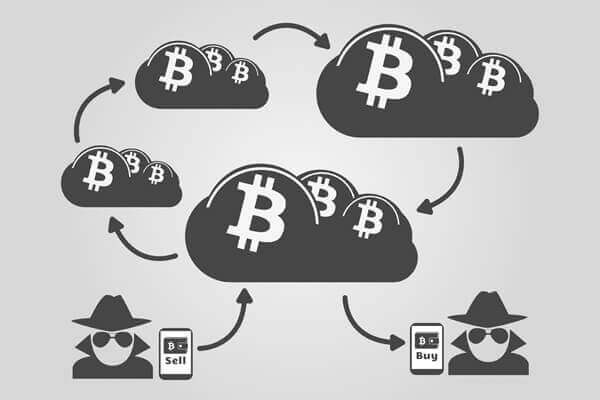

Buying BTC Anonymously

Depending on the level of privacy you wish to maintain, it is quite possible to purchase BTC anonymously.

There are exchanges that offer the anonymous purchase of bitcoins without verification, apart from a credit card, but take into account that limits, in that case, are low in most exchanges.

Some exchanges offer cash purchases without any sort of verification, especially those that are peer-to-peer based and ATM BTC cash out purchases are also privacy friendly. Whatever methods you choose to make sure you research the exchange you wish to buy bitcoins from to avoid scams and ID information theft.

When Will You Receive Your BTC?

Depends on the method you choose and broker you trade with. Cash transactions depend on exchange and on the broker as they could take their time verifying your payment (from 3 to 24 hours). Credit/debit card payments are usually instantly carried out, as is the purchase of BTC through ATM machine, but they usually take high transaction fee compared with cash purchases.

Problems with Bitcoin: Scam Sites and Minings

If the product or asset is experiencing sharp growth, so does the number of scammers and scam sites that wish to profit unfairly from it. Many of them would offer you promotions that “you cannot pass”, unrealistic returns for bitcoin investments. They are becoming more sophisticated in their schemes and very often cannot be outright deemed as real or fake.

Their website might look professional, have great customer service and would even fabricate information and location information in order to lure you into investing your money in them, only to never see either bitcoins or investment ever again.

A way to hedge against such scams is to communicate with bitcoin community to identify these sites and dig information about them. You could also visit website like BadBitcoin who lists problematic exchanges and their tactics of luring investors in.

Bitcoin Transaction Fees

Fees vary from exchange broker to next and between purchase methods. Cash purchases could vary from 1% to 2% if the transaction is done through peer-to-peer or 6% to 10% if purchased directly from exchange broker. ATM purchases could vary from 6% to 10%, while credit and debit card purchases vary from 3% to 4%. For example, Coinbase deposit fees vary from 0% (ACH transfer) to 3.99% (debit/credit card).

| Country | Payment Method | Deposit Fees* | Funds Available | Currency |

|---|---|---|---|---|

| Credit/Debit Card | 3.99% | Instant | ||

| U.S. Bank Account (ACH Transfer) | 1.49% | Instant | ||

| U.S. Bank Account (Wire Transfer) | $10 | 3-5 Business Days | ||

| PayPal (withdrawal only) | 3.99% | Instant | ||

| Credit/Debit Card | 3.99% | Instant | CAD | |

| Credit/Debit Card | 3.99% | Instant | AUD | |

| Credit/Debit Card (3D Secure Only) | 3.99% | Instant | ||

| Bank Transfers (International SEPA in euros) | 1.49% | 1-2 Business Days | ONLY | |

| Credit/Debit Card (3D Secure Only) | 3.99% | Instant | ||

| Bank Transfers (SEPA) | 1.49% | 1-2 Business Days | ||

| Credit/Debit Card | 3.99% | Instant | SGD |

Privacy is also viewed as added value to the customer, thus those exchanges that offer a high level of privacy through anonymous purchases charge a lot higher transaction fees than those that do not.

BTC Payment: How to Buy Bitcoins?

There are many ways to turn paper money into BTC and each of them carries different perks and issues with them. These methods are:

- Cash.

- Credit or debit card.

- PayPal.

- Bank transfer.

- ATM.

- Virtual card purchase methods.

| Exchange | Deposit Fees | Countries | Buy Bitcoin | |

|---|---|---|---|---|

| Coinbase | 3.99% (credit/debit card), 1.49% (bank account) | USA, Canada, Australia, UK, Europe, Singapore | BUY NOW |

| Changelly | Higher than average (instant credit/debit card purchases, no ID verification required) | USA, Global | BUY NOW |

| Coinmama | 7.25% fee, minimum 10 USD (credit/debit card) | USA (22 states), Global At this moment, Coinmama exchange supports 40 U.S. states | BUY NOW |

| LocalBitcoins | 1% plus transaction fees | USA, Global | BUY NOW |

| BitPanda | 3-4% (credit/debit card), small surcharge (SEPA, EPS) | UK, Europe | BUY NOW |

| Coinhouse | 6-10% (credit/debit card) | UK, Europe | BUY NOW |

| Kraken | $5 (wire), free (SEPA) | USA (37 states), UK, Europe | BUY NOW |

| CEX.io | 3.5% + $0.25 (credit/debit card), $10 (bank transfer) | USA, Global | BUY NOW |

The number of exchanges, as mentioned before, is growing and there are many exchanges and traders willing to trade with you. The BTC purchase could be done through peer-to-peer or directly with one of the best bitcoin exchange broker.

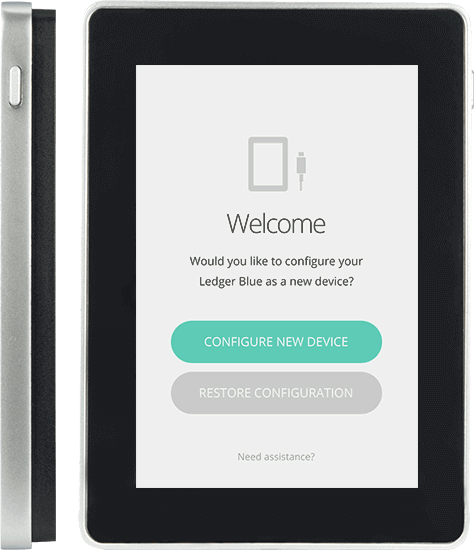

Best Bitcoin Wallets: How to Choose Right?

There are several wallets variants that you can choose from. They differ in terms of security from theft and hacking schemes and pricing. Each of them has their pros and cons that need to be considered when choosing which type of BTC wallet to have. There are three categories of BTC wallet currently in the market, them being web-based e-wallets, Armory wallet software, and hardware wallet.

| Screen | Hardware Wallet | Crypto Currencies | Price | Buy |

|---|---|---|---|---|

| Ledger Blue | Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Dogecoin (DOGE), Dash, Zcash (ZEC), Stratis (STRAT) | €277.09 + €23 shipping to the USA | MORE INFO |

| Ledger Nano S | Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Dogecoin (DOGE), DASH, Zcash (ZEC), Stratis (STRAT) | 79€ (VAT exc.) including free shipping | MORE INFO |

| KeepKey | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), DASH, Namecoin (NMC) | $129 + $15 shipping | MORE INFO |

| Trezor | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), DASH, Zcash (ZEC) | €89 + €26 shipping to the USA | MORE INFO |

Web-based wallets offer security guaranteed by the provider with their own encryption and security tools. Do take into account that, although comfortable, they carry great risks with themselves, as hacking into big provider’s network has been recorded in the past.

Armory software creates a deterministic offline wallet that could be used in the online and offline environment.

The hardware wallets are the next big thing, as they provide security against hacking and theft due to a suitable encryption and stores of private keys in a secured offline environment.

The hardware wallets are the next big thing, as they provide security against hacking and theft due to a suitable encryption and stores of private keys in a secured offline environment.

Fastest Ways to Buy BTC

The fastest ways to purchase BTC are through bank card and ATM machines. Credit and debit card transactions at Coinbase are fairly quick, though they are dependent on the level of verification that exchange broker requires from you. These most popular payment methods are:

- credit & debit card;

- PayPal;

- bank account;

- cash through bitcoin ATM.

| Exchange | Deposit Fees | Countries | Buy Bitcoin | |

|---|---|---|---|---|

| Coinbase | 3.99% (credit/debit card), 1.49% (bank account) | USA, Canada, Australia, UK, Europe, Singapore | BUY NOW |

| Changelly | Higher than average (instant credit/debit card purchases, no ID verification required) | USA, Global | BUY NOW |

| Coinmama | 7.25% fee, minimum 10 USD (credit/debit card) | USA (22 states), Global At this moment, Coinmama exchange supports 40 U.S. states | BUY NOW |

| LocalBitcoins | 1% plus transaction fees | USA, Global | BUY NOW |

| BitPanda | 3-4% (credit/debit card), small surcharge (SEPA, EPS) | UK, Europe | BUY NOW |

| Coinhouse | 6-10% (credit/debit card) | UK, Europe | BUY NOW |

| Kraken | $5 (wire), free (SEPA) | USA (37 states), UK, Europe | BUY NOW |

| CEX.io | 3.5% + $0.25 (credit/debit card), $10 (bank transfer) | USA, Global | BUY NOW |

ATM machine, on the other hand, could be considered as definitely the fastest way to obtain bitcoins, but they come with a high transaction fee of 6% and more depending on the provider.

Where to Get Bitcoin?

Currently, you can purchase BTC through various exchange brokers or exchange platforms. Some of them would deliver bitcoins from their own sources while others are peer-to-peer based, where traders exchange bitcoins between themselves.

Additional way on how to change perfect money into bitcoins is ATM machine, whose number is growing fast all over the globe. Another way to get bitcoin is through stores located near you. These stores act as any other exchange offices with a difference that they trade with bitcoin (and possible other cryptocurrencies), examples being LibertyX and Bitit.

Buy Bitcoin with Credit Card

Internet shopping has been on the rise for some time now and credit card purchases are becoming as common as cash purchases in a supermarket. As you can purchase your favorite book or food online, so can you buy bitcoins! The purchase process is rather simple and instantaneous compared to other paying methods.

Fees vary from provider to provider, and are in the range between 2% and 6%, depending on the amount purchased and broker that offers the BTC. Take care that broker is reputable and known as the credit card scams do happen. Consult yourself with BTC community on the brokers’ reputation and past practices so you know if it is safe to give your credit card details to them.

Bitcoin with Virtual Credit Card

The virtual credit card is a great way to check the exchange broker or platform if you are unsure of their intentions. Since VCC number is generated online, you could check the bitcoin broker by giving them your virtual CC details and then see how the transaction will go.

Since they have limited time and can be used only by one vendor, the Virtual CCs offer protection from the scams but do take care that they provide even less protection than regular credit cards have.

MasterCard

The purchase of bitcoins with MasterCard has its perks depending on the issuer. Depending on the tier of benefits that your MasterCard is, you could be protected from the scams and price manipulations that some exchanges are prone to.

Brokers could charge you an additional fee if you choose to make payment through this card, so make sure you read their pricing and fees policy in order not to be surprised when the bill comes your way.

Visa

The debit card shares more similarities with MasterCard and Maestro than differences, but the main perk is the 24/7 protection you get Visa Signature cards. Since Visa does not offer price protection (although some Visa providers do nevertheless) some exchanges might offer free-of-fee purchase should you choose this method of payment.

Maestro

Maestro cards could serve as either the card of your current account in the associate banks or they could act as debit prepaid cards.

The disadvantage with this method of purchase is that many exchanges do not accept payments through prepaid cards as they are used at the point of sale (POS) and need to be swiped through the payment terminal which many exchanges do not possess. On the other hand, they could be used in most stores and ATM without any problems.

How to Purchase Bitcoins with Debit Card?

Purchase process with a debit card is much similar with a credit card and many exchanges offer both credit and debit card purchases simultaneously. Take care that most likely, the bitcoin provider would ask for your ID verification (with selfie at that!) to ensure you do intend to pay for your bitcoin inquiry.

Buy Bitcoin with PayPal

As the PayPal’s current policy forbids the transactions with bitcoin, many are wondering how to convert bitcoin to PayPal. It is hard to find exchanges that offer PayPal as a WebMoney purchase option. Those that do (LocalBitcoins for example) usually charge high fees and require you to verify your account with your ID details.

You could buy BTC with PayPal by trading with another cryptocurrency like SLL (Second Life Linden Dollars) for bitcoins at exchange VirWox.

Another way is to link a physical bitcoin debit card offered by Wirex and connect your PayPal account with that card and make purchases of bitcoins directly as well.

Getting BTC with Cash

Apart from CC/DC purchase methods, buying bitcoins could be done through cash purchases as well. The cash purchases could be done either directly with the exchange broker or through peer-to-peer platforms like PM exchange website LocalBitcoins. Another way to purchase bitcoins for cash is through ATM machines.

You could also do bank transfers for those traders and brokers who accept them, though make sure your partners are reliable to work with.

Fees are usually low at peer-to-peer trading while exchange store and ATM purchases come with high fees as these cash transactions are instantaneous and provide higher privacy level than peer-to-peer trading.

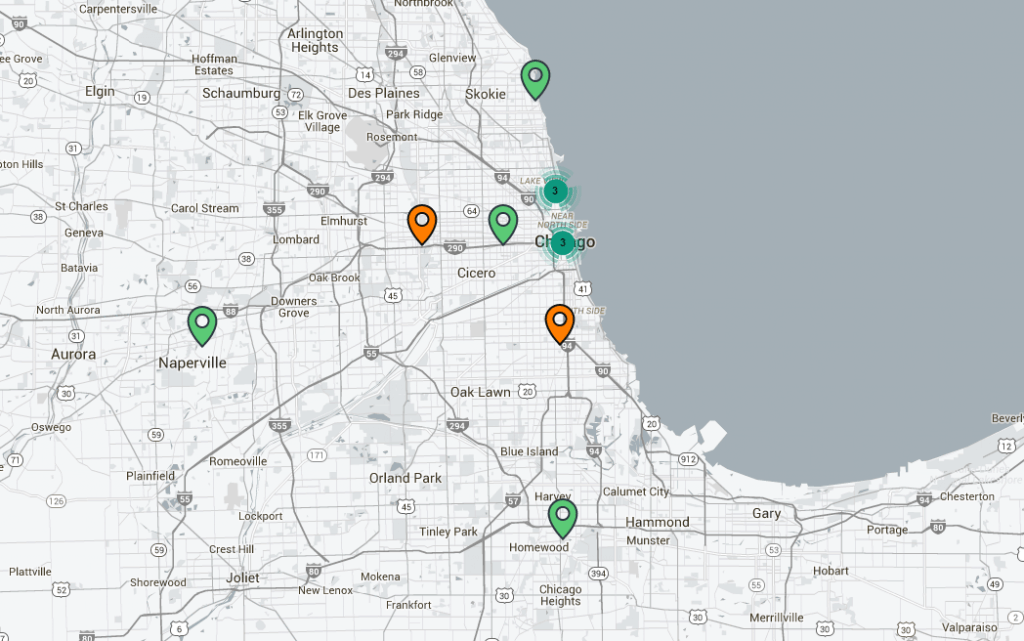

Bitcoin ATMs Near Me

To find the nearest ATM to you, you could use bitcoin ATM map on your smartphone or PC easily to locate the nearest ATM. The map pins provide information about the ATM in terms of fees (between 5% and 10% depending on the manufacturer), bitcoin price and service hours.

Once you have located the nearest ATM machine, click on “Read More” to see the details of the ATM manufacturer, working hours and fees.

ATMs offer various payment methods, from cash to credit/debit cards and Bitcoin ATM Map pins also give the list of payment methods, limits and other useful information that you need to make your decision.

BTC with Bank Account

Another method of buying bitcoins is through bank account transfers, where you go physically to your local bank, make a cash payment and send a receipt to the bitcoin provider as a proof of purchase. Many exchanges offer this method of payment, like Coinbase, BitPanda, and CEX.io, while peer to peer transactions are also usually done through bank transfer.

The downside of this method of purchase is the time the bank needs to process the payment and it could take up to 5 business days for the transaction to be completed. Be sure to know whom you are sending your money to, as the bank transfers cannot be reversed once carried out.

Other Ways to Get Bitcoins

Apart from credit/debit cards, cash purchases and PayPal, you can get bitcoins through several other means:

- accept bitcoins as means of payment (suitable for online business owners);

- complete tasks at websites for free bitcoins (very risky and requires research of those websites);

- mine your own BTC (great way if you have a capital to invest in machinery and energy to produce BTC as each block gives a stack of 25 bitcoins);

- through gambling (not recommended method as it carries a huge amount of risk).

Other Bitcoins Questions

What Is the Best Time to Buy Bitcoins?

When to buy bitcoins? Bitcoin price is a highly fluctuating currency, whose value changes by the hour, if not by the minute. There are many factors that decide the worth of the bitcoin as the cryptocurrency is not centralized and no one can say for sure at what time you should purchase the bitcoin.

What is important for you is that once you do purchase bitcoins, they are yours. The only advice we can give you is to purchase the bitcoin when the price is acceptable for you and to not worry too much – the value will go up over time anyways!

How Long Does It Take to Get BTC?

The purchase process depends on the method of payment and on the exchange provider. Cash payments usually could last between 3 to 24 hours depending on whether you are purchasing BTC through peer-to-peer or directly from the broker online or in the store while credit/debit card purchases and ATM machines would deposit bitcoins to your wallet instantly.

An additional factor is the payment verification process, which is instantaneous with card payments and longer with cash and bank account payments due to the security reasons.

Physical Bitcoin

It is very hard to find a physical bitcoin in the commercialized world. Being the cryptocurrency, the BTC that could be traded exists only digitally and is processed (and produced by miners) on the internet. Production of the physical bitcoins has been started by many companies around the globe and, so far, their products have not been accepted by wider audiences as of yet.

There are several physical bitcoin products that you can investigate should you wish, with most famous being the Alitin Mint, Titan bitcoin, Cryptmint Coins and Casascius Coins.

Can I Sell Bitcoins?

In various exchange websites, you could sell as well as buy bitcoins. Peer-to-peer bitcoin trading is done both ways, as the trader, much like yourself, bought the BTC before he sold to you. After you buy your BTCs, you can sell them to the next trader who is willing to pay the amount and with a method of your choice.

Additionally, there are brokers who would also purchase bitcoins from you, though their pricing strategies are usually revolving at lowest purchase price possible, so compare them with the market prices in other exchanges to get the best deal.

Who Can Get BTC?

Anyone! From individuals to businesses, bitcoin is available to every average person at any point of time. The only constraints are the number of exchanges that you can trade bitcoins with as these brokers offer their services for different regions. Some of them do offer global service, regardless of the region, but nevertheless, analyze which exchange brokers are available for your country.

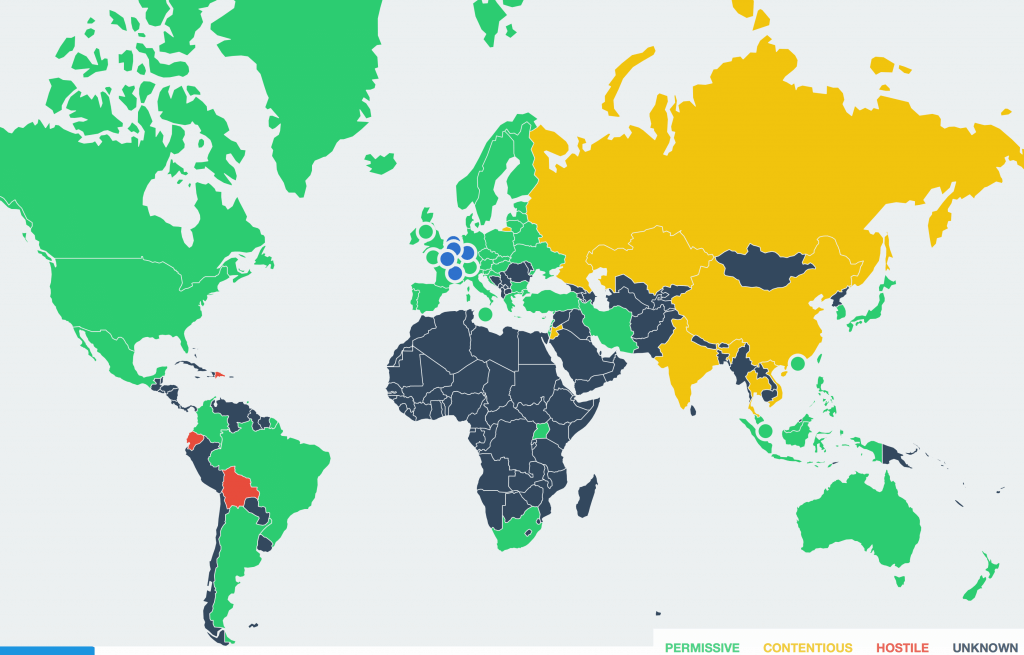

If you are not a resident in the country where bitcoin is deemed as illegal, you can trade freely with BTC or even produce it with mining.

Can You Buy a Fraction of a Bitcoin?

Of course, you can! The bits of the BTC can go as far as 0.000000001 as every BTC is divided into 1 million units; each called a “satoshi” – the smallest bitcoin unit. The process of buying a fracture of BTC is basically the same with purchasing the whole BTC – you simply put the amount you wish to buy and find the BTC provider who is willing to trade the amount with you. Sale of fractured BTC is available in all exchange places, in peer-to-peer, stores, ATMs and exchange brokers as well. Below is the conversion system for you to familiarize yourself with the concept of the bitcoin fractions:

- 1 mBTC (milli-Bitcoin) = 0.001 bitcoin or 1/1000 of bitcoin (a thousandth of a bitcoin);

- 1 uBTC (micro-Bitcoin) or 1 bit = 0.0000001 bitcoin, or 0.001 mBTC (a millionth of a bitcoin);

- 1 satoshi = 0.000000001 bitcoin or 0.01 uBTC (a satoshi is the smallest unit of bitcoin).

What Is Better – Buy or Mine Bitcoins?

Mine or buy? Depends on your capital and effort you wish to invest in BTC trading. The buy option requires much less capital and effort than mining, as you can start with small purchases at the beginning. Then you can build the BTC amount by purchasing cheap and selling expensive later on, though there is significant chance that you might lose your money due to the fluctuations.

The mining requires a starting capital as you need to buy equipment for mining BTCs (worth starting from $10,000). The profitability of the mining is dependent on mining difficulty, electricity costs and block halving (currently after a block you earn 25 BTCs, though soon it will be 12.5). Thus, we advise beginners to try their hand at trading with the BTC first so they could get to know the industry better.

Do You Need a Bitcoin Account?

Yes, you do need to get a bitcoin account in order to receive your BTC from transactions. You can either have your own bitcoin wallet or you can have an account in various exchange websites.

We would advise you to keep the wallet and account to yourself though, as the websites have been attacked few times in the past. These attacks have stripped many traders of their bitcoins, so it is better to keep them safe in either computer or on USB.

Why Do People Buy Bitcoins?

People buy BTC for two reasons: either to gain profit from the trade by buying cheap and selling expensive or to gain another payment method for online shopping as many online shops offer great discounts for goods and services purchased with bitcoins.

Bitcoin has grown in value and use in the past years and it does not show any sign of stopping as of yet. As many people figured out how to put money on bitcoin, online shopping businesses have recognized the growing potential of the BTC and are increasing in a number of those who have added bitcoins as another purchase mean.

Can You Buy Stock in Bitcoins?

Does bitcoin have stock access? Yes, but rare are those providers who offer such transaction and they are always riskier to work with than if you have decided to invest in BTC only. One of those providers is 1Broker, who lets you trade in commodities, Forex, US stocks and cryptocurrencies using bitcoin. You would need to transfer the bitcoins from your wallet to their website first though in order to start trading stocks with bitcoins.

Is bitcoin a stock itself? It is a currency, a digital one and thus it is not a stock.

Why Is Bitcoin So Popular in China?

Due to the political establishment in the country, Chinese investors see quite a few benefits that cryptocurrencies bring to the table. Most blockchain networks enforce decentralized marketplace, with privacy one of the main pillars. Additionally, due to the lack of control, the market depends on pure demand and supply trends, leaving manipulation behind.

The supply aspect is what attracted China’s businesses the most since BTC mining operations brought back a nice return for investors. Until 2017, most of the provided hash power came from China. Reason for such trend was simple – it bypassed government’s control. Since most of the largest mining pools came from China, it is no wonder that authorities decided to put a stop to them, and are not going to make mining legal.

Are BTCs Legal and Safe?

In bitcoin countries, BTC trade is legal, with exceptions of Bolivia, Ecuador, Kyrgyzstan, and Bangladesh currently. In these countries, bitcoin mining and trade is considered as a crime of money laundering and is punishable by law.

How is bitcoin secure? BTC trade safety depends on the purchase method and exchange broker. Peer-to-peer trades are considered to be one of the most unsafe methods of BTC trading (though also the most profitable if a trader is reputable) alongside with website brokers that are new. There are many exchanges that have built their reputation in BTC trade and though not 100% all the time, they are upgrading security measures as the time passes.

Is Buying BTC Anonymous?

There are many exchanges that offer to buy bitcoins anonymously and without any sort of verification though usually at higher fees. An example of anonymous purchase would be Coinmama, where you could purchase bitcoins with CC/DC with a limit of $150 for the first time buy and $5,000 daily after a month.

Additionally, anonymous purchases could also be done through ATM machines as the purchase process involves cash or card payments on the spot with no verification and no ID either. ATM purchases also have high fees, as you pay for privacy.

What About Multiple Exchanges?

It is quite possible (and preferable even) to trade in multiple exchanges at the same time. You might even combine various payment methods at different exchanges, depending on the fees and BTC transfer speed.

All you have to do is to register yourself in those exchanges and then trade within these exchanges at the same time. That way, you would cover a larger number of bitcoin markets while increasing your chance to get rich off different BTC prices across the brokers.

The only downside of multiple exchange trade is the higher tracking effort that you need to exert in order to successfully follow the results of your activities.

Do You Need to Pay Taxes on Bitcoin?

In the USA, the rise of bitcoins has been closely followed by the US governmental bodies that have deemed bitcoins to be an asset rather than a currency due to its decentralized nature.

It is expected of every bitcoin trader to record their bitcoin trade activities and report the results to the officials and pay a capital gains tax. The following transactions would lead American traders towards tax liability:

- selling bitcoins, mined personally, to a third party;

- selling bitcoins, bought from someone to a third party;

- using bitcoins, which one may have mined, to buy goods or services;

- using bitcoins, bought from someone, to buy goods or services.

How to Get BTC Besides Buying

There are several ways on how to gain bitcoins apart from trading activities and those are:

- Mining operations (you would need to invest around $10,000 for machinery in order to farm BTCs).

- Fulfill website tasks to gain free BTC (could be risky if the said site asked for your personal/bank card information or for any type of payment).

- Accept payments in BTC (if you are a business owner or freelancer).

- Create your own BTC exchange business (if you have capital and knowledge of the BTC and various payment/selling transactions).

Bitcoin Problems: Avoid Scam

Check Reviews and Ratings

Whether you are buying bitcoins by a fellow trader or from Broker, always check their reviews and ratings from different sources if possible. Sites have a reputation to hold, and chances are that several online communities would already have people reviewing their experiences with that particular exchange in detail.

Peer-to-peer trading is even riskier so make sure you trade with a person who has a sound history of transactions and good reviews from previous trades. The higher number of good reviews, the more secure the trader is to do BTC business with.

Use Escrow

An escrow service is done by the operator of the online exchange platform. The bitcoins are transferred from buyer’s wallet to the site’s escrow and are held there until the transaction is complete. It allows safer payment environments for BTC sellers, who are hedged against the sale risk while buyers are guaranteed their BTC amount as long as the transaction is done as agreed.

Do be careful with your money, as operators need to be trusted to hold the bitcoins for you. The operators could take the BTC from you or the major external attack could strip the BTC amount if the hacking activity is carried out successfully.

Avoid Altcoins

As the name says, the altcoins are all other coins that are not a bitcoin. They are usually not different from BTC in any aspect, from mining to trade methods. Additionally, most of them are very short-lived, thus investment in them could end in the total loss for the trader as they do not rival the bitcoin’s infrastructure. There are a fewer number of brokers and exchanges of altcoins than the ones who trade bitcoins.

They are very volatile compared to bitcoin and are prone to large changes in a very short period of time, making the future prospects of the altcoin very hard to foresee.

Bitcoins Security Issues

Concerning the bitcoin’s future prospects, we can safely say that the BTC is here to stay. The BTC infrastructure looks great and does not show any signs of stopping for a foreseeable future.

However, that is not to say that bitcoin does not have security issues. Below is the list of security problems that you need to be aware of when trading bitcoins at any point of time:

- hacking of major websites;

- wallet breach;

- credit card details theft;

- peer-to-peer and website scams.

Online BTC Wallets

Yes, we do agree that Online BTC wallets are very convenient and could serve as a fast-response asset when you trade bitcoins, especially in cases of peer-to-peer trade. But you also need to take into account the security issues that come along with your online BTC wallet.

The first problem would be an exchange broker who has your online wallet. It would be quite easy for him to take your entire bitcoin amount as the exchanger you trust keeps them for you.

The second problem is the external threats that bitcoin online exchanges face every day. The cyber crime has been on the rise in the past years, with BTC exchanges feeling the pain from BTC lost through hacking activities.

Use Bitcoin Hardware Wallet

The hardware wallet proposes the most secure way of controlling and guarding your bitcoins at the moment. They are very easy to use and even easier to backup as you can use both Computer and USB for storage, depending on your needs and preferences. These bitcoin USB wallets are small and work in online and offline mode and they have a minimum margin of error.

The hardware wallets vary in size, design, perks, and price. Bellow table is the graphic presentation of various physical wallets in Amazon.com that are for sale.

| Screen | Hardware Wallet | Crypto Currencies | Price |

|---|---|---|---|

| Ledger Blue | BTC, XRP, ETH, ETC, LTC, DOGE, DASH, ZEC, STRAT | €277.09 + €23 shipping to the USA More Details |

| Ledger Nano S | BTC, XRP, ETH, ETC, LTC, DOGE, DASH, ZEC, STRAT | More Details |

| KeepKey | BTC, ETH, LTC, DOGE, DASH, NMC | $129 + $15 shipping More Details |

| Trezor | BTC, ETH, LTC, DASH, ZEC | €89 + €26 shipping to the USA More Details |

Bitcoins in Different Countries

Purchase Bitcoin in the UK

Although the British government has made itself a clear supporter of a cryptocurrency, the UK banks are still reluctant to forge local partnerships with exchange business, thus you would most likely be forced to use SEPA bank transfers, which makes your funds arrive in 2 to 5 days after the transaction. It is worthy to note that in recent months, efforts have been exerted by getting the UK more closely to bitcoin in terms of contracts and partnerships between businesses, banks, and exchanges.

The renowned exchanges who serve the United Kingdom are Coinbase, Bitstamp, Coinfloor, and CoinCorner. The broker that you could buy bitcoins from that operates in the UK is QuickBT, while P2P marketplaces are Bittylicious, BitBargain, LocalBitcoins, Coinfloor Market and CryptoMate.

There are also bitcoin UK ATM machines that are located all around the UK, check out the ATM machine map to locate the nearest one to you and the purchase could be done in GBP.

How to Get Bitcoins in Canada

There are many Canadian-based exchanges that you could use to get bitcoins, most famous example being QuadrigaCX, an exchange base in Vancouver, CanadianBitcoin who is located in Ottawa and Morrex in Quebec. LocalBitcoins could be used in Canada as it is peer-to-peer based, while other helpful Canadian websites are Quebex.com which offers advice on how to get BTC Canada and regarding the Canadian government bitcoin tax requirements.

You could also use ATM machines that are near you, while international brokerages that you can trade in with are Coinbase, Coinmama, and GDAX. Do take into account that these brokerages offer transactions in USD only as of the moment.

Buy BTC in Australia Anonymously

There are four ways that allow you to buy bitcoins anonymously in Australia. The most popular bitcoin exchange in Australia is Coinbase. The second way is through P2P markets in LocalBitcoins. All you need to do is to find an Australian trader who would accept cash payment from you without any details regarding who you are.

Another is ATM machines that are located in Australia (12 locations at the moment, with most located in Melbourne – 7 of them).

Lastly, you could use prepaid debit cards in local Australian brokers such as BuyaBitcoin, where you would swipe the card in person without any ID verification, a process similar to any other purchase you make in supermarkets or convenience stores.

Bitcoin in China

Not so long ago, there were various bitcoin websites offering the BTC trade, the most famous one – ZBcom allowing to trade without charging a fee. The international bitcoin investment was limited to the sum of 350,000 Yuan (around $50,000) which allowed Chinese citizens who live abroad to trade actively with their peers in China without issues.

Now, the only way for bitcoin buyers to get their hands on digital coins is through crypto-to-crypto transactions. Huobi worked out a process where clients can swap altcoins and bitcoin around, bypassing the ban. Apart from buying, to sell bitcoins in China is also difficult, since banks do not allow any sort of transactions going on. Recently, the government blocked even social media ads related to crypto and ICO, negatively affecting bitcoin’s price as a consequence.

At this point, it is practically impossible to buy BTC in China through fiats due to the extensive governmental crackdown. At first, domestic trading and exchange services were banned, making the BTC mining illegal as well. Bank transfers are not possible, cash purchases even less.

Where to Buy Bitcoins in India?

The leading bitcoin platform in India is Unocoin, who offers bitcoin purchases through NEFT and RTGS. The minimum amount of purchase stands around 1,000 INR (approximately $15) while the transaction fees are one of the lowest in the region, standing at 1% and could even go down to 0.7% depending on the volume.

Another regulated bitcoin platform and a broker is Zebpay. Based in India, it offers Android and iPhone apps for BTC purchases through connected bank account. The fees are not shown transparently but are rather part of the purchase price.

The last broker that is Indian based is Coinsecure, a broker that offers the lowest transaction fee for buyers, though their website could be confusing for the first-timers.

Japanese Bitcoin

The largest Japanese based bitcoin exchange is bitFlyer and is, in fact, one of the largest marketplaces for bitcoins in the world. You can purchase the BTCs via credit card or bank transfers at the very low transactions fees of 0.15%. It offers private transactions at the monthly limit of 250,000 JPY, while the purchase amount is unlimited for fully verified a user which gives an opportunity to buy large amounts of BTC.

Other exchanges that are available in Japan are Coinmama, LocalBitcoins, Coincheck (Japanese based), and ATM bitcoin machines.

Order BTC in Germany

The BTC exchange brokers and platforms that operate in Germany are Coinbase (the most popular), Coinhouse, Coinmama, Indacoin, Kraken, LocalBitcoins, Bitcoin.de (based in Germany), CoinGate, SpectroCoin, BitPanda and many other less known operators.

The payment method, as with the rest of the Europe, ranges from cash purchases in P2P and ATM machines to SEPA bank transfers and credit/debit card purchases.

BTC in Nigeria

The exchanges that operate in Nigeria are brokers and P2P platforms like Luno, LocalBitcoins, Coinmama, Indacoin, CoinGate and BitPanda. The best option currently is deemed to be Luno, as it is backed by investors who are based in America, has low fees (from 1% to 0.5% depending on the volume purchased), and high limits (up to 2,000 EUR daily and 30,000 EUR monthly).

Bitcoins in Saudi Arabia

One of the popular choices for bitcoin purchase and BTC business endeavors in Saudi Arabia is through Paxful. The site offers a P2P market platform for traders to purchase and sell bitcoins with many methods like bank transfers, gift cards, PayPal, Western Union, MoneyGram and your personal debit/credit cards.

The Paxful also offers affiliate programs for bitcoin sellers who could earn up to 2% on each trade should they wish to open bitcoin Kiosk through Paxful.

Getting BTC in Nepal and Malaysia

As with Nigeria, Luno is also one of the best places to buy bitcoins in Malaysia, due to the payment options (Interbank GIRO and IBFT), low transaction fee (from 1% to 0.5% depending on the volume purchased) and high limits for purchases (1,000 EUR daily and 62,000 EUR monthly).

Buying bitcoins in Nepal could be done through P2P (LocalBitcoins) and through brokers (Coins-E, CEX.io, and many others) with the most popular e-commerce site for bitcoin being Harilo.

How to Earn Bitcoins?

How to profit from bitcoins? There are several ways to earn bitcoins and make the profit out of the BTC business. The first is through purchase and sale of the BTC. You want to make sure you buy at the low peak and sell at the high peak of the BTC price, so you could purchase even more BTC in the future and repeat the procedure.

Another way to make money with bitcoin is through mining operations. It is costly (over $10,000 needed investment currently) and gives 25 BTC per block at the moment, though it is expected for BTC per block to be divided by half soon.

Making money with bitcoin through this option is for the veterans, who have been in the industry for some time and know the ropes well. How long does it take to mine a bitcoin? Quite a long time if you do not possess the right equipment for it!

Another way of earning BTC is to lend BTC to other businesses and charge interest worth in bitcoin. The interest rate could go from 5% to 40%, depending on the amount and timetable of payment as well.

Bitcoin Apps

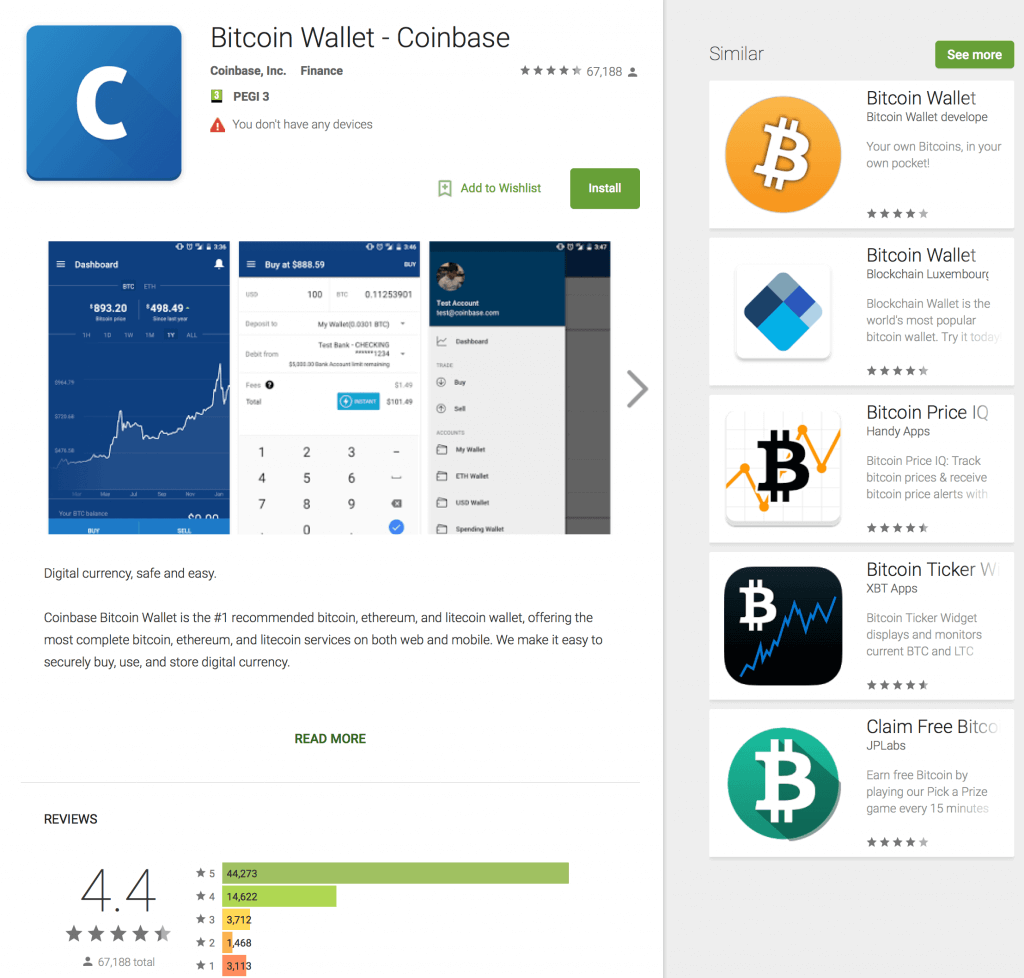

The mobile applications that support the bitcoin trade are iOS app and apps for Android, supported by many exchange brokers and e-commerce markets, where you could purchase BTCs with few taps on your phone.

iOS App

The iOS app allows the users to purchase bitcoins with one tap on the phone and it allows traders to create and maintain their wallets safely, the most famous BTC wallet online being the Coinbase, Blockchain, and Breadwallet.

The Breadwallet app offers the ability to store and purchase bitcoins either by cash, ATM machine transactions or by linking the bank account to Breadwallet.

The exchange brokers are also jumping the wagon on iPhone market, by offering QR code purchases and iOS apps available for download that would make bitcoin trade faster than ever.

App for Android

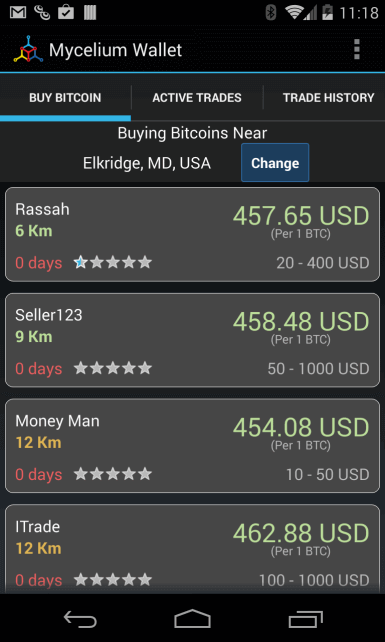

For the majority that uses a Smartphone, the bitcoin Android app is a very comfortable tool in BTC purchase. Exchanges like Coinbase, Mycelium, and LibertyX are offering Android apps for bitcoin purchases (or map for ATM machines and stores in the case of LibertyX) where you could purchase bitcoins as easily as you would from the PC.

The apps are frequently updated as the security measures need to be strengthened quite often, due to the high-risk potential for hackers to enter the wallets based on those apps.